Comprehensive Financial Education

Your Path to Financial Success

At Lelixa, we understand that financial education is not just about knowledge; it's about fostering a mindset of financial empowerment. Our holistic approach encompasses various aspects of personal finance, ensuring clients are well-equipped to face financial challenges with confidence. With tailored programs that cater to individual needs, we strive to transform financial literacy into a powerful tool for success.

Holistic Financial Education

At Lelixa, we understand that each financial journey is unique. Our services are customized to meet the specific needs of our clients, ensuring that they receive the right education and support to thrive financially. From foundational principles to advanced strategies, we are committed to empowering individuals with the knowledge they need to achieve financial independence.

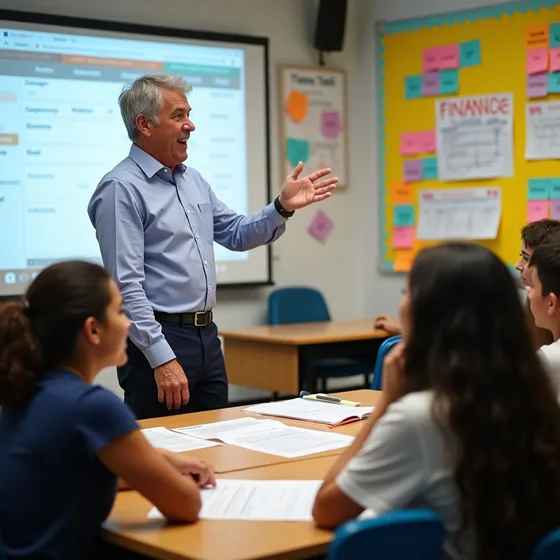

Practical Financial Tools

Our approach focuses on interactive learning experiences that encourage participation and retention of financial knowledge. Through group discussions, real-life scenarios, and hands-on activities, we ensure that our clients can apply what they learn in their daily lives. This practical approach has resulted in a 75% retention rate of financial concepts taught, equipping clients with skills they can use immediately.

Tailored Financial Education

Explore practical strategies for managing your expenses effectively, empowering you to take control of your finances. Learn how to create a realistic budget that aligns with your financial goals and fosters long-term stability.

Tools for Financial Success

Our mission is to create financially savvy individuals who can manage their money with confidence. Through targeted education and practical tools, we aim to reduce financial anxiety and promote sustainable financial habits. In a recent study, 80% of our clients reported a significant decrease in financial stress after participating in our programs.

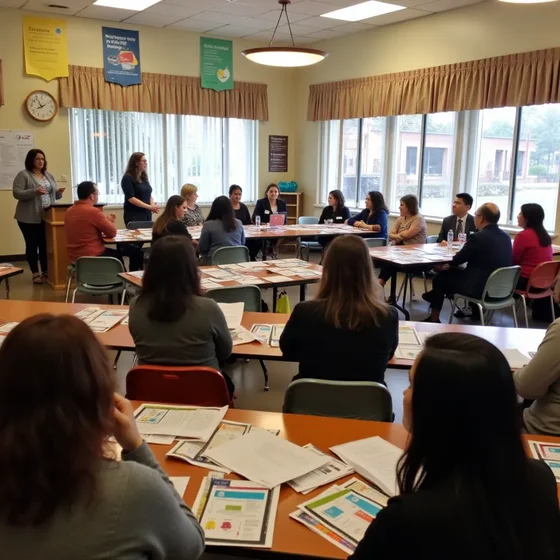

Workshops and Seminars

We conduct engaging workshops and seminars that cover a wide range of personal finance topics. These events not only provide valuable information but also foster community engagement among participants. With an average attendance of 100 individuals per workshop, our events have become a hub for people looking to enhance their financial knowledge through shared learning experiences.